Contents

You should ask the firm with which you deal for details about the types of redress available in both your home jurisdiction and other relevant jurisdictions before you start to trade. This information, which is set out below, does not disclose all of the risks and other significant aspects of trading in futures contracts, options or other derivatives. In light of the risks, you should undertake such transactions only if you understand the nature of the contracts into which you are entering and the extent of your exposure to risk. Trading in derivatives is not suitable for many members of the public. You should carefully consider whether trading is appropriate for you in light of your experience, objectives, financial resources and other relevant circumstances. Our proprietary trading platform provides powerful analytics tools for chart traders and straightforward capabilities for new traders.

In some jurisdictions, and only then in restricted circumstances, firms are permitted to effect off-exchange transactions. The firm with which you deal may be acting as your counterparty to the transaction. It may be difficult or impossible to liquidate an existing position, to assess the value, to determine a fair price or to assess the exposure to risk. For these reasons, these transactions may involve increased risks. Before you begin to trade, you should obtain a clear explanation of all commissions, fees and other charges for which you will be liable.

Only risk 10% or less of your account balance at any given time. Add the cash value of your entire exposure to the market , and never let that amount exceed 10 times your equity. Once you have a trading plan that uses a proper risk-reward ratio, the next challenge is to stick to the plan. Historically, this simple adage has been difficult to adhere to. Our data shows EUR/USD trades closed out at a profit 61% of the time.

What About Other Currency Pairs?

Thus, traders should evaluate their tolerance for possible losses before engaging in CFD trading. The products attracted the interest of institutional investors and hedge funds, and several equity market makers began to offer them as over-the-counter products. CFDs later gained interest from individual investors and in the late 1990s, they were launched as a retail product by Gerard and National Intercommodities through its electronic trading system. Open a live trading account and you will become a real trader with real money. It has all the functions of a real account (streaming forex prices, pip, P/L, charts, etc.), but the money isn’t real.

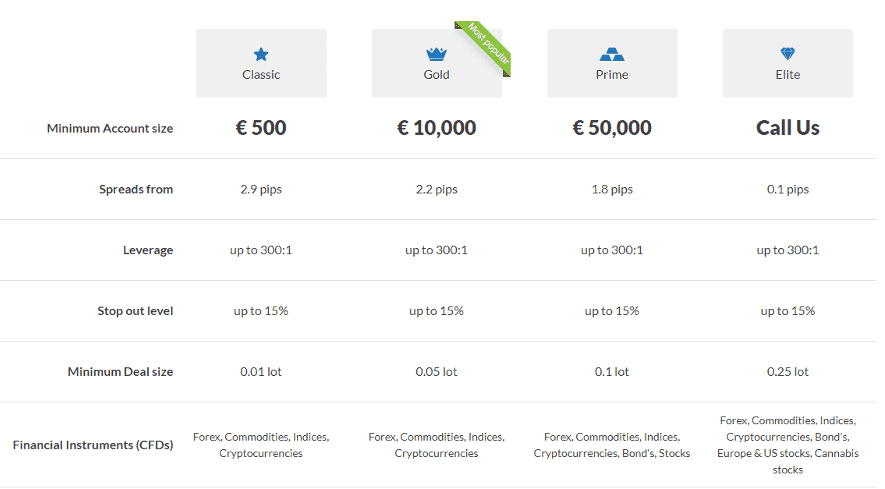

These charges will affect your net profit or increase your loss. With all Friedberg Direct account types, you pay only the spread to trade indices and commodities. Our enhanced index CFDs allow you to trade without stop and limit restrictions or re-quotes. You can get deep discounts on your spread costs based on the volume you trade.

We have grouped all these needed skills together into an interactive trading course. You can learn how to analyze and trade the market from experienced instructors and traders. They teach using video-ondemand lessons and live office hours are available so you can get personal feedback, study on any schedule, and learn at your own pace. This also allows you access to leverage, which can increase your profits and your losses.

Successful Traders Trade The Right Time of Day

But the average losing trade was worth 83 pips while the average winner was only 48 pips. Traders lost 70% more on their fxcm broker review losing trades than they won on winning trades. Remember that past performance is no indication of future results.

Transactions on markets in other jurisdictions, including markets formally linked to a domestic market, may expose you to additional risk. Such markets may be subject to regulation which may offer different or diminished investor protection. Before you trade you should inquire about any rules relevant to your particular transactions. Your local regulatory authority will be unable to compel the enforcement of the rules of regulatory authorities or markets in other jurisdictions where your transactions have been effected.

- A pip in a standard demo account in EUR/USD is worth $1.00 per lot.

- The monetary value of a pip can vary according to the size of your trade and the currency you are trading.

- We`d like to emphasize that leverage is a double-edged sword and can dramatically amplify your profits as well as losses.

- Monthly trading volume is the sum of all trades in terms of notional volume in USD for a given month.

- As it pertains to any business ― active trading or otherwise ― profit is the difference between gains and losses minus operating expenses.

Ultimately, the responsibility falls upon the trader to be aware of local tax laws and reporting duties. The modest initial capital outlay required for share CFDs warrants a strong risk management gameplan. Conservative money management, the use of stop loss orders and addressing risk to reward on a trade-by-trade basis are a few ways to limit market exposure.

Any losses incurred with CFDs can be used to offset payment of capital gains taxes on profits. Thus, if the peroidic closing price of the underlying instrument rises, the buyer profits; and if it falls, the seller profits. Size and expiration for other types of instruments are based on the contract for the underlying asset. CFDs were first developed on the London Stock Exchange in the 1980s by market maker Smith New Court. The products emerged in response to interest from investors who wanted to be able to sell stocks short without having to first take the costly and complicated step of borrowing them.

Why does Friedberg Direct encourage lower leverage?

Online forex trading has become very popular in the past decade because it offers traders several advantages. Thousands of individual traders around the world can now trade currencies from their living rooms, with nothing but a computer, an Internet connection, and a small trading account. Trade full set of popular currency pairs and CFDs with our improved execution system and no restrictions for stop and limit orders.

Many traders come to the forex market for the wide availability of leverage — the ability to control a trading position larger than your available capital. However, while using high leverage has the potential to increase your gains, it can just as quickly, and perhaps more importantly, magnify your losses. For the average retail trader, enhanced leverage helps to maximise capital efficiency. In effect, small amounts of money may be used to control vastly larger positions in the market. Consequently, many trading strategies that were previously too expensive become potentially viable. Among the most popular are scalping, reversal, trend, dollar-cost-averaging and reversion-to-the-mean methodologies.

To understand the true size of your positions, you have to consider the notional value of the position created. Once you have the Notional Volume, you can calculate the actual leverage used. We`d like to emphasize that leverage is a double-edged sword and can dramatically amplify your profits as well as losses. Trading foreign exchange/CFDs with any level of leverage may not be suitable for all investors. Friedberg Mercantile Group Ltd. (“Friedberg Direct”) is an independent legal entity and does not own, control or operate this third-party website. Because CFDs can be obtained with low margins, they can expose traders to the potential not only for large gains, but also to large losses.

Conventional financial wisdom suggests that it takes a lot of money to participate in the markets. That is the beauty of https://forexbroker-listing.com/ the forex ― you don’t need to be a millionaire to trade. At the end of the day, making money is the goal of any trader.

Finding Effective Leverage

Whether your outlook on a currency is bullish or bearish, you have the ability to capitalise upon the idea. Buy low and sell high or sell high and buy low ― the forex does not limit your trading options or your money-making potential. CFD trading allows you to trade the price movements of currency, stock indices and commodities like gold and oil without buying the underlying product. Accounts are opened with and are held by Friedberg Direct which clears trades through a subsidiary within the FXCM group of companies (collectively, the “FXCM Group”). Customers of Friedberg Direct may, in part, be serviced through subsidiaries within the FXCM Group. The FXCM Group does not own or control any part of Friedberg Direct and is headquartered at 20 Gresham Street, 4th Floor, London EC2V 7JE, United Kingdom.

So, you now know what forex traders do all day ( and all night! ). Currencies trade on an open market, just like stocks, bonds, computers, cars, and many other goods and services. A currency’s value will fluctuate depending on its supply and demand, just like anything else. If something increases supply or lowers demand for a currency, that currency will fall. For example, when Greece threatened to default on its debt, it threatened the existence of the euro, and investors around the world rushed to sell euros.

So, if you think the eurozone is going to break apart, you can sell the euro and buy the dollar. If you think the Federal Reserve is printing too much money, you can sell the dollar and buy the euro. Many have not heard of the forex market because the market has historically been largely exclusive to industry professionals. The average person could buy a stock but couldn’t trade currencies. Say that you decided to hold on to 500 euros, and left them sitting in your desk drawer for 5 years. In 2007, you took your euros to the bank and sold them for a 2007 price of $1.40.

The calculation is very similar, except that in CFDs there is a “multiplier” factor added in that varies with every product. Derivatives offered to Quebec residents are authorized by the Quebec AMF. If at any time your Usable Margin falls to zero, your positions will be triggered to immediately liquidate.